You Don’t Have to

Face the IRS Alone

IRS debt is overwhelming. We help you take control, find real solutions, and finally get your life back.

You Don’t Have to

Face the IRS Alone

IRS debt is overwhelming. We help you take control, find real solutions, and finally get your life back.

Owing the IRS Feels Hopeless

No one should have to live under that kind of stress.

A Team You Can Trust

We understand what it feels like to be trapped by IRS debt.

For over 20 years, our small, family-run team has helped thousands

of people resolve their tax problems.

Quick Wins We Can Help You Achieve From

Day 1

Quick Wins We Can Help

You Achieve From Day 1

These are the kinds of outcomes

our clients pursue every day.

5000+

CLIENTS

REPRESENTED

6

INDIVIDUALS DEDICATED TO SOLVING YOUR TAX PROBLEMS

INDIVIDUALS DEDICATED TO

SOLVING YOUR TAX PROBLEMS

3000+

OFFERS IN COMPROMISE

Your 3-Step Plan to Relief

Avoid guesswork. We'll give you a clear,

straightforward path to resolve your IRS debt.

Ways We Can Help

If you ignore IRS debt,

it only gets worse…

If you ignore IRS debt, it only gets worse…

Bigger penalties, garnished wages, emptied bank accounts and constant stress.

But with the right help, you can stop the harassment and finally breathe again.

Bigger penalties, garnished wages, emptied

bank accounts and constant stress.

But with the right help, you can stop the

harassment and finally breathe again.

Imagine the relief of opening your mailbox without fear.

Imagine sleeping at night without wondering if the IRS will take your paycheck.

That’s the freedom we help our

clients achieve every day.

Imagine sleeping at night without wondering

if the IRS will take your paycheck.

That’s the freedom we help our

clients achieve every day.

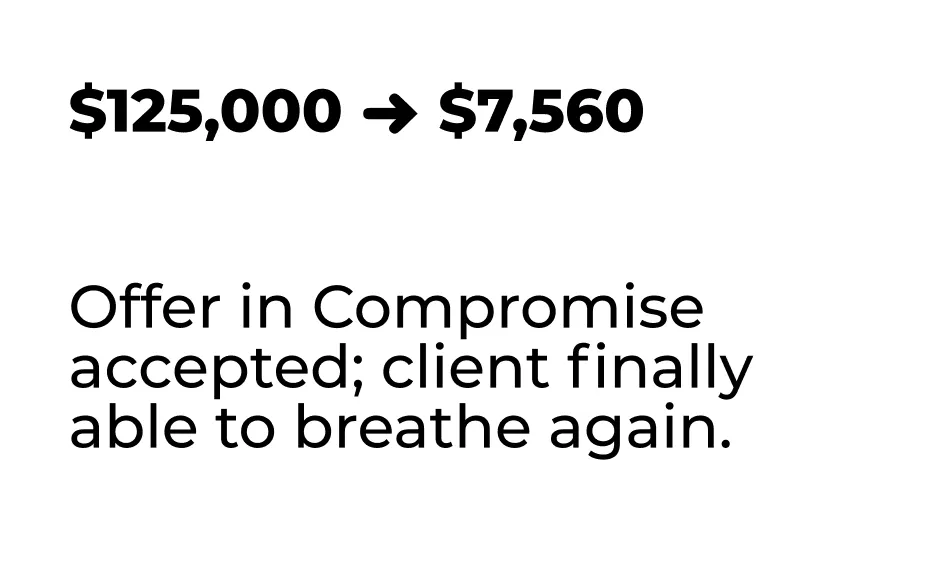

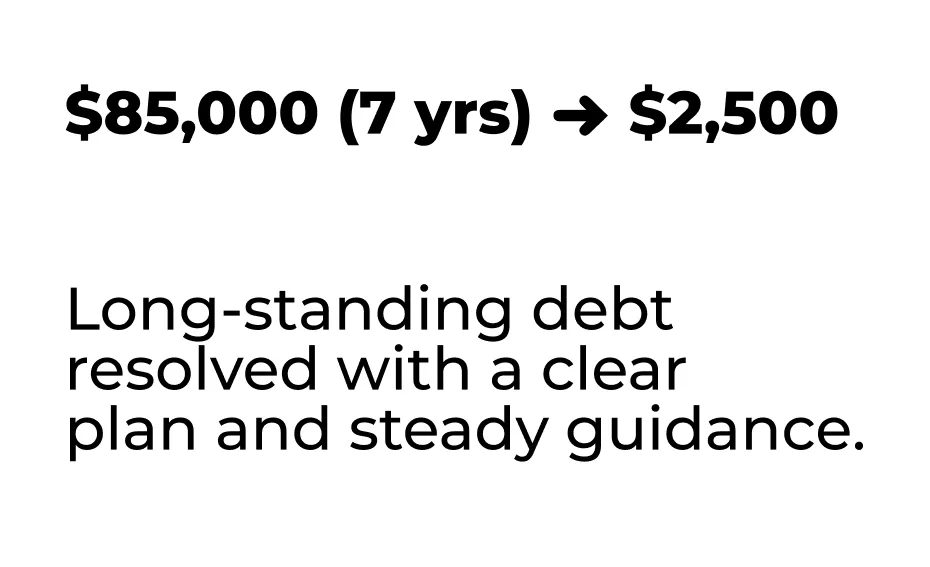

Quick Wins We Can Help

You Achieve From Day 1

Quick Wins We Can Help You Achieve From

Day 1

Recent client outcomes (anonymized)

show what's possible.

Let’s Talk When You’re Ready

You don’t have to solve this alone. We’re here to listen — no pressure, no judgment.

Book Your Free 30-Minute Consultation

Free 30-Minute Consultation — No Pressure. Just an honest conversation about your situation and a clear next step.

Free 30-Minute Consultation — No Pressure.

Just an honest conversation about your situation and a clear next step.